In the last 18 months, I have been working more actively on managing and defining a securities portfolio. I aimed to create a portfolio reflecting my values and investment philosophy.

I would describe myself as a "Growth value investor." I buy and hold securities for the long term (over several years). I do not buy derivatives and do not short stocks. I am investing in companies positioned in fast-growing markets, but I also want to invest at a fair value.

Buying "growth companies" at fair value is a real challenge as the market consistently prices in its growth expectations. Consequently, growth companies always have higher valuations and are generally more expensive. I try to buy these stocks when the market undervalues them.

I also consider myself an "impact investor". I invest in companies that deliver positive impacts to society. My primary motivation when creating my portfolio was to exclude specific sectors I did not want to support with my money. These sectors were all fossil fuels, tobacco, and military supply.

It is complicated to exclude these sectors as most indexes and associated ETFs have solid exposure to them (especially for fossil fuels). Very few asset managers have excluded O&G activities from their investment strategies.

The "4Gs" Portfolio

My current investment strategy relies on four dimensions, which I named the "4Gs" portfolio. It reflects my area of interest and past experiences. The 4Gs stand for:

- Gray or Healthcare Tech: Companies providing products and services to cater to our aging population. (40-45% of the portfolio)

- Green or Climate Tech: Companies supporting climate mitigation and the energy transition. (35-40% of the portfolio)

- Gratification or Generational Tech: Companies focused on entertainment and lifestyle. (15-25% of the portfolio)

- Global: I invest globally, prioritizing the company's value over location. This includes exposure to various currencies, with non-US, non-EU securities at 10-15% today.

I use simple tools to manage my portfolio, relying on Yahoo Finance, Simply Wall Street, and Excel. I read company reports, join earnings calls, and stay informed about portfolio companies and their competitors. My portfolio includes 40-50 stocks, and I monitor 20-30 more as potential investments. I follow another 100-150 listed companies, mainly Climate Tech related.

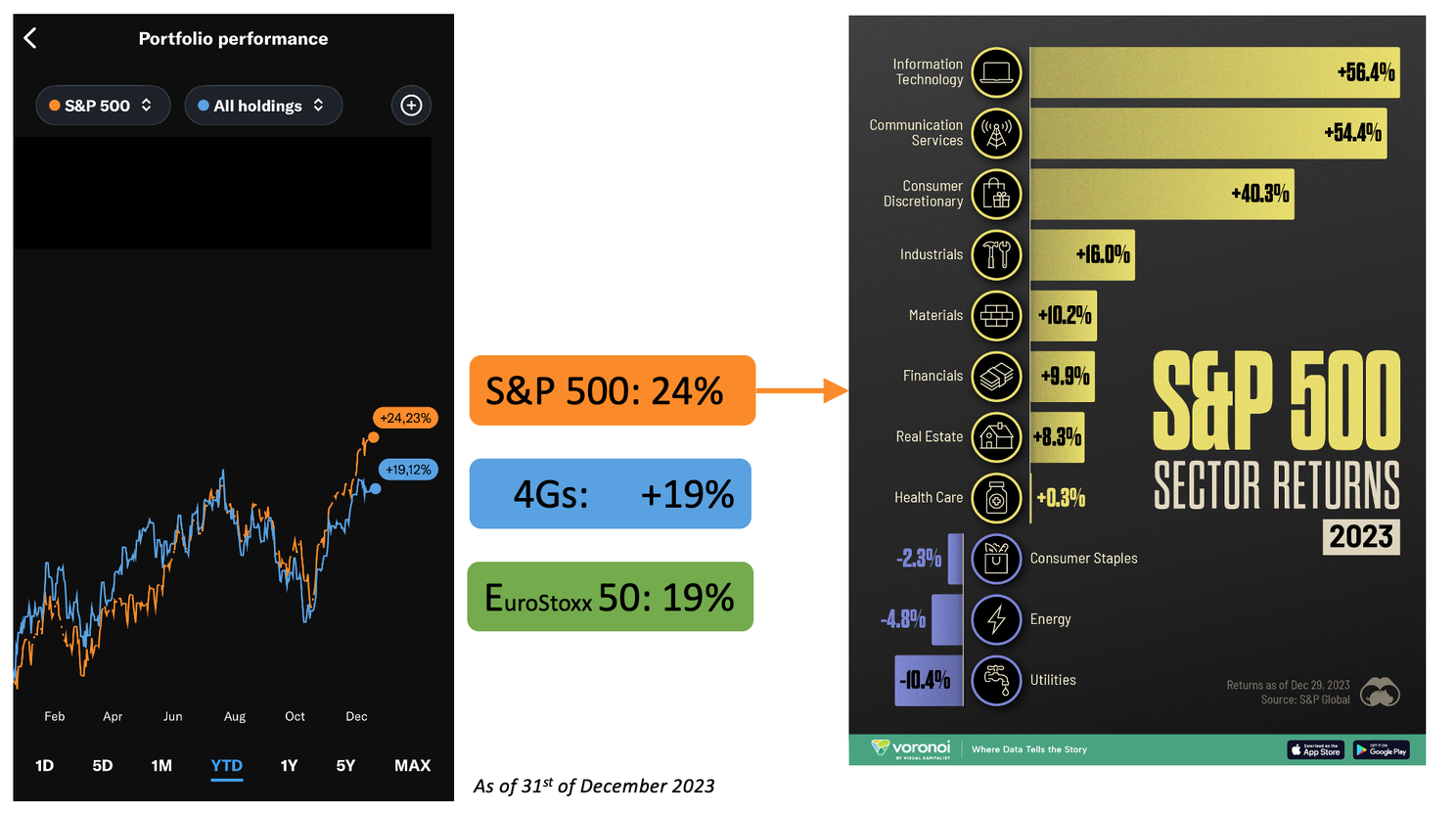

All dividends are reinvested in the portfolio to compound. Below is an overview of the portfolio's 2023 performance excluding dividends and before taxes.

2023 Performance

The 4Gs portfolio ended 2023 with a 19% gain, just below the S&P500 and on par with the EuroStoxx 50. The portfolio's volatility was close to the S&P 500's.

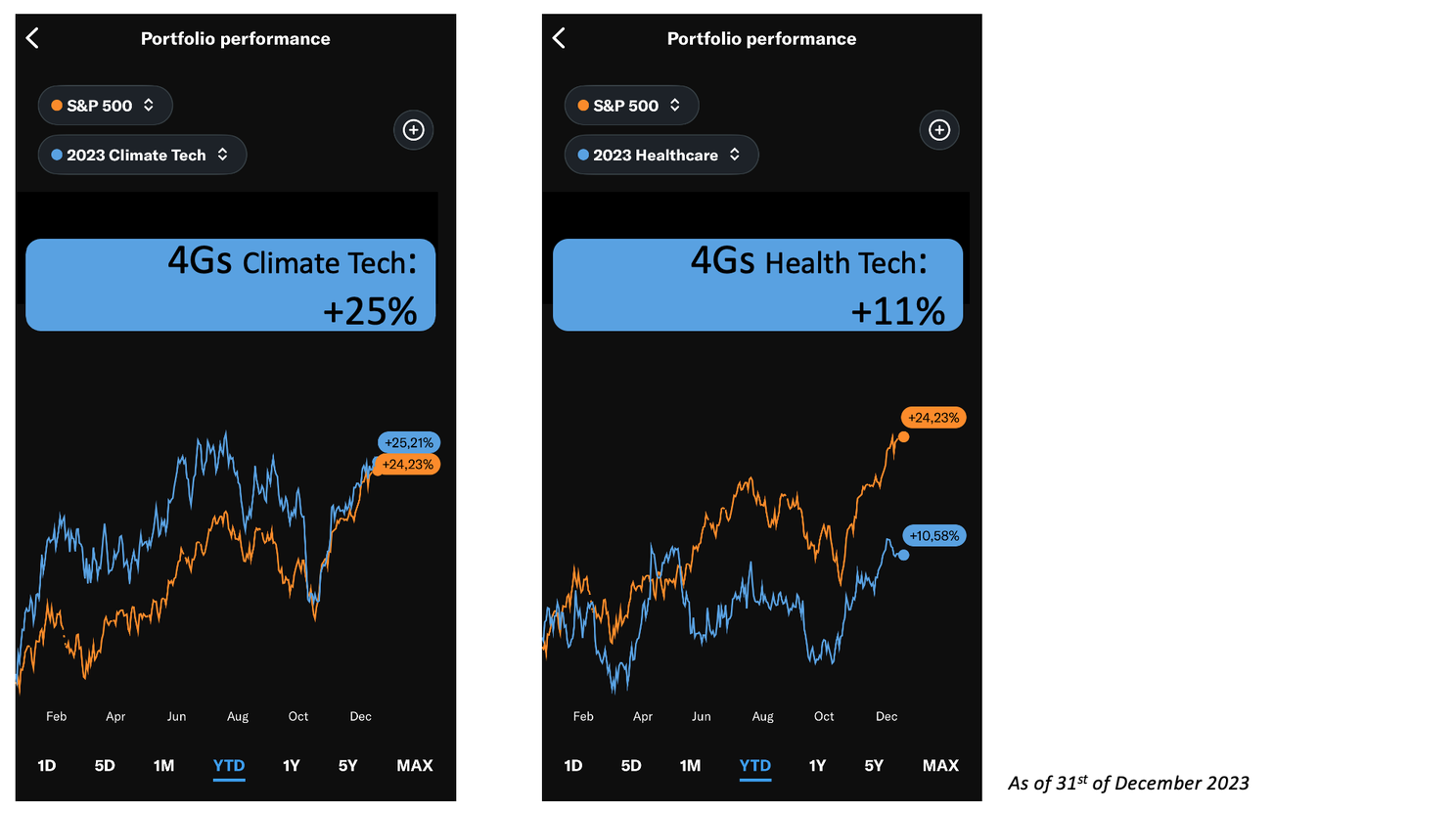

Climate Tech, despite a volatile year, closed at +25%.

Health Tech saw a modest 11% gain, outperforming the overall healthcare sector in the S&P 500.

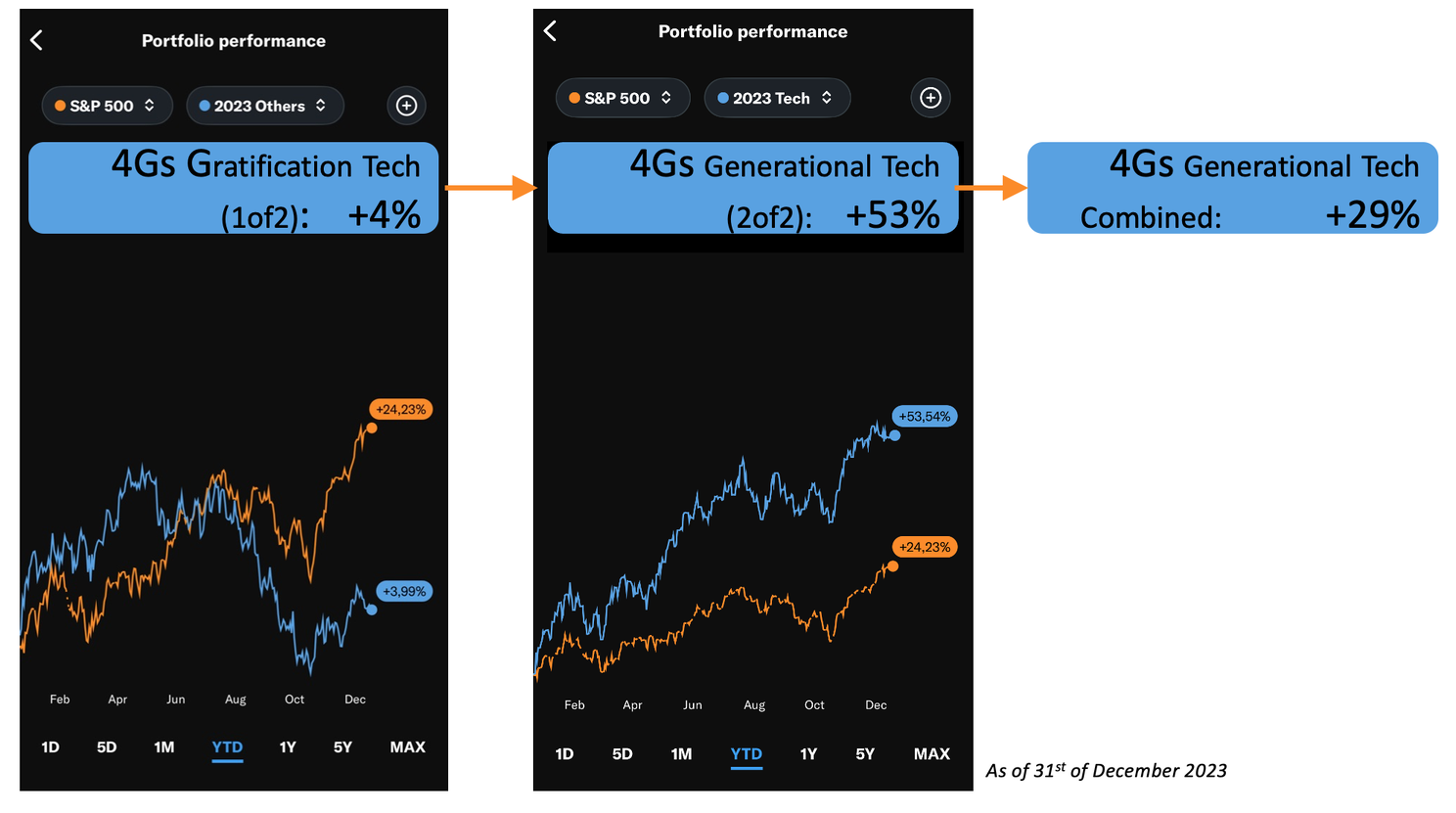

Generational/Gratification Tech led with a 29% increase, primarily due to its tech companies' performance.

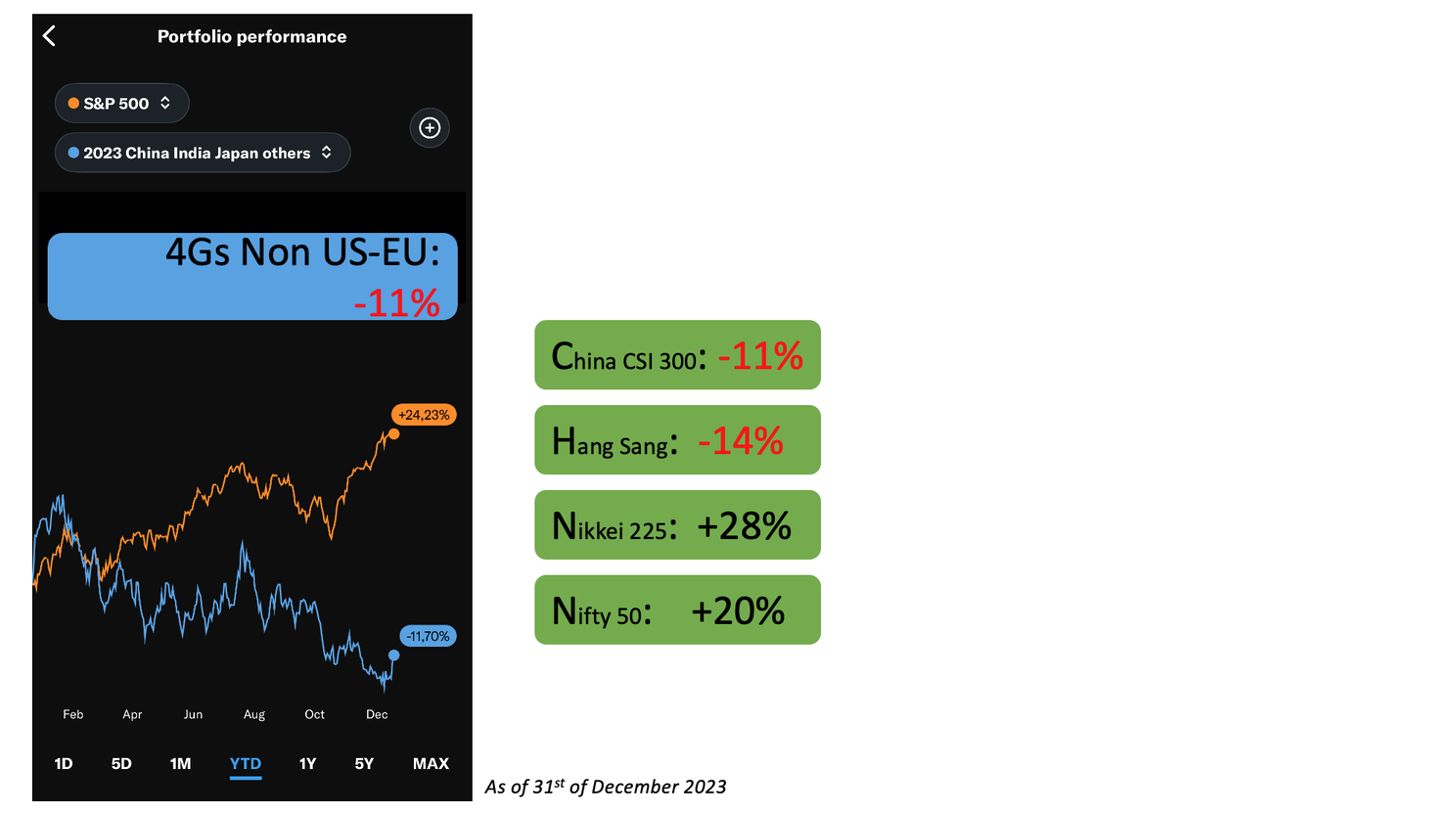

The '4Gs' portfolio performance was negatively impacted by the performance of the non-US-EU companies (mainly China in fact). Chinese equities suffered extensively in 2023. And most Asian currencies have been very weak in 2023 compared to the USD and Euro.

Top Holdings

As of early 2024, the fiftheen biggest holdings in the 4Gs portfolio include:

Air Liquide, Alphabet, Apple, EssilorLuxottica, General Electric, Kering, Longi Green Energy Technology, LVMH, Microsoft, Netflix, NextEra Energy Inc, Schneider Electric, Tesla, Sonova, and Waste Management.

Why I Enjoy Investing

People often ask me why I like managing my portfolio and making such investments. A very relevant and attractive investment strategy would be to invest in an Index like the S&P500 through an ETF.

I find it a fascinating intellectual exercise as it requires accumulating and analyzing a lot of information about the world: technologies, companies, markets, and all other various forces that influence our societies and economies.

It is also a fantastic personal exercise for self-awareness. Investors need to have an excellent understanding of themself to understand how their biases and emotions can influence their decisions. Investors need also to be aware of others' emotions and biases.

It is difficult to not fall down this fantastic rabbit hole!

Let’s see what 2024 has to offer!

Disclaimer

NO INVESTMENT ADVICE

The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained in my article constitutes a solicitation, recommendation, endorsement, or offer by me or any third-party service provider to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. All Content on this post is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in the Site constitutes professional and/or financial advice, nor does any information on the Site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto.

INVESTMENT RISKS

There are risks associated with investing in securities. Investing in stocks, bonds, exchange traded funds, mutual funds, and money market funds involve risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including a greater volatility and political, economic and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.