In 2023, I decided to formalize my investment thesis, the 4Gs portfolio, and its associated investment criteria.

My current investment strategy relies on four dimensions, I named it the 4Gs portfolio. It reflects my area of interest and past experiences.

The 4Gs stand for :

- Grey:These companies provide products and services to cater to our aging population. 45% of the portfolio.

- Green (Climate Tech): companies providing products and services that support climate mitigation and the energy transition.31% of the portfolio.

- Gratification / Generational: companies providing products and services to please/entertain people. 24% of the portfolio.

- Global: I invest in companies all over the world. My focus is on the company and its products/services rather than its country of origin. My portfolio includes securities from the EU, US, China, UK, Japan, Korea, India, etc... It also means the portfolio consists of several currencies. Exposure to non-US, non-EU listed securities represents 15% of the portfolio.

In 2024, my investment thesis remained unchanged, as it is rooted in long-term societal and technological transformations.

On a tactical level, I focused on increasing the portfolio's dividend yield to enable regular reinvestment without the need to exit existing positions.

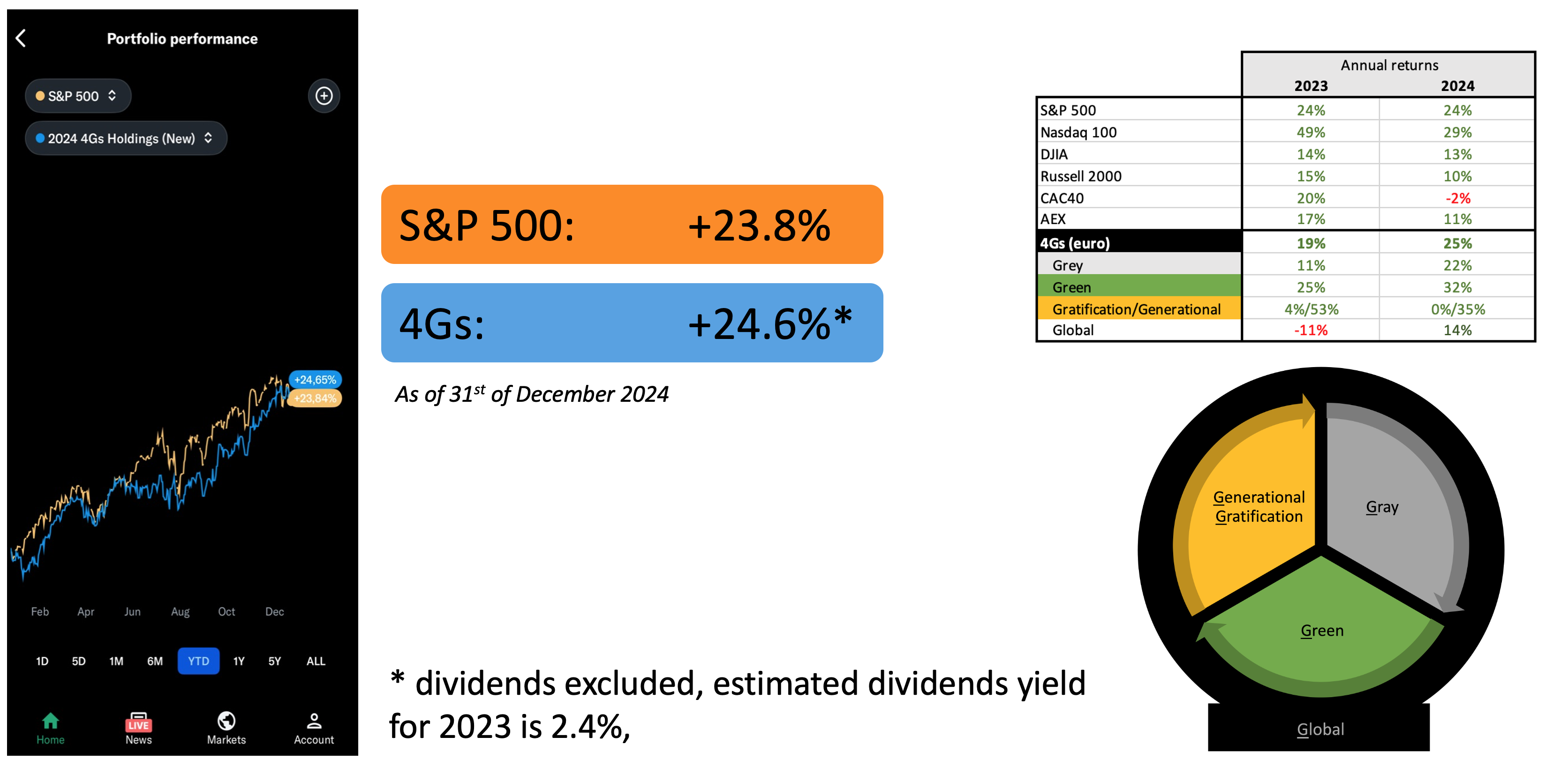

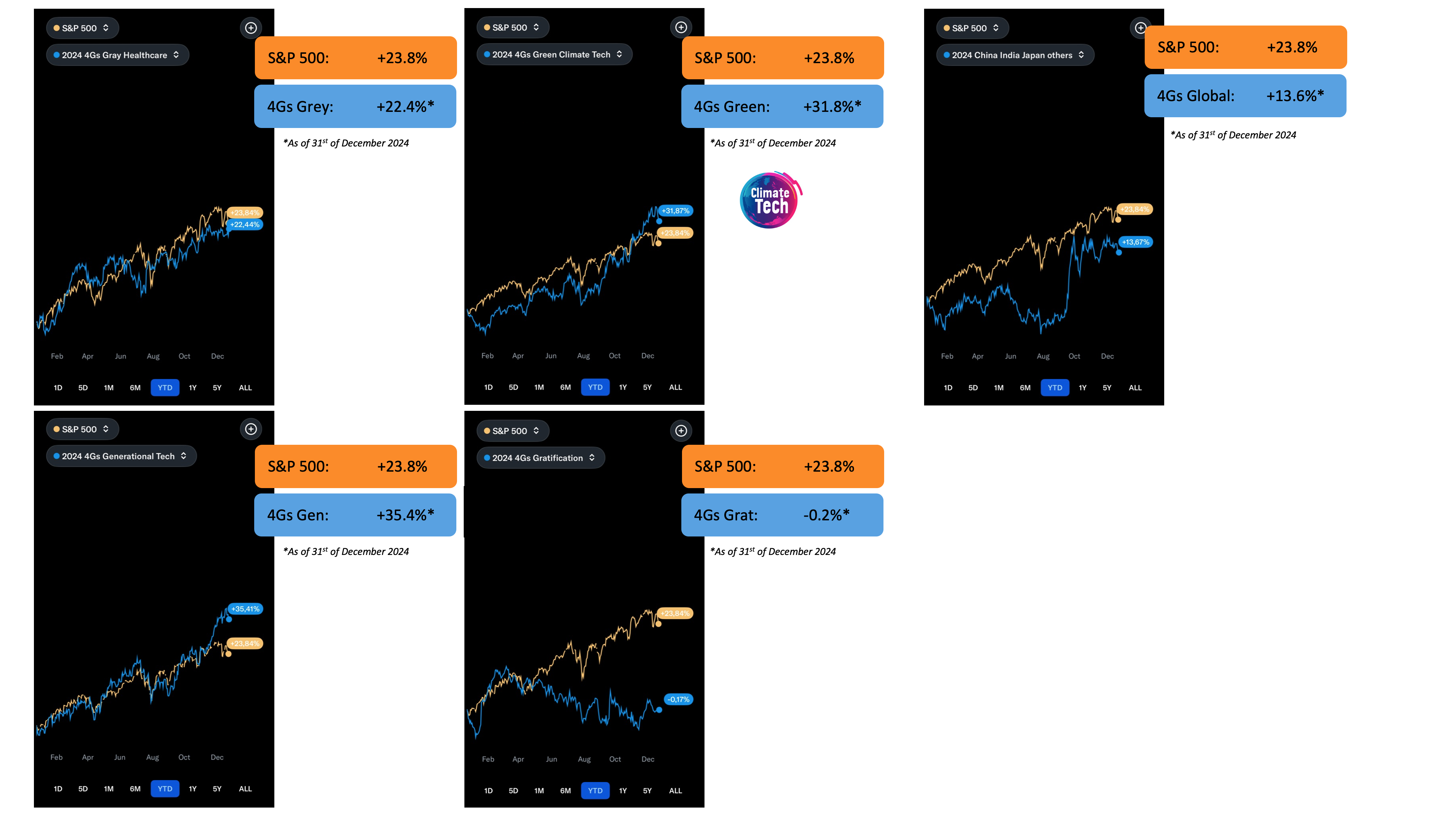

2024 Annual Returns

In 2024, the 4Gs portfolio outperformed the S&P 500, achieving an impressive annual return of 24.6% in euros, excluding dividends received during this period.

The portfolio’s performance was primarily driven by the Green (+32%) and Generational (+35%) segments, bolstered by a strong year for EssilorLuxottica, which remains its largest holding of the Gray segment.

Both Green and Generational segments benefited indirectly from the momentum generated by the Artificial Intelligence boom and the corresponding demand for clean power generation and grid modernization.

After a challenging start to 2024, global equities in emerging markets—particularly China—rebounded strongly, ending the year with double-digit growth.

What did change in 2024

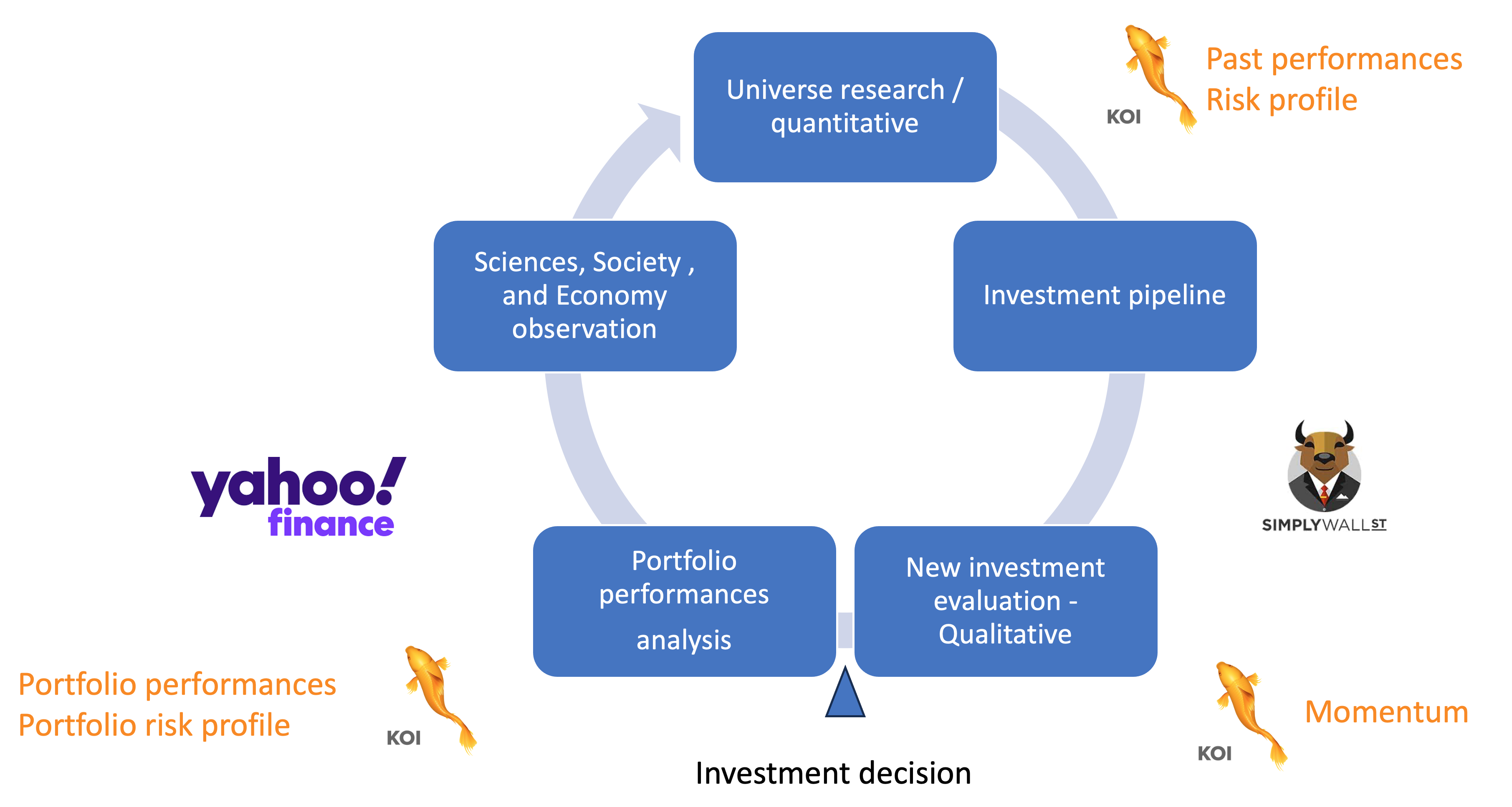

One of my goals in 2024 was to strengthen further my investment process by finding new ways to screen the market for potential companies and to improve the timing of my investments.

To do so, I built for a few months my own Python libraries to help me doing so by leveraging the data available through Yahoo!finance. The result is the KOI project and is available on GitHub.

KOI libraries provide the following features:

- Stock and Currency Support: Supports all stocks and currencies available on Yahoo Finance.

- Currency Reference: Specify USD or EUR as the reference currency for analysis.

- Weighting Methodologies: Choose between equal weighting (`iso`), custom weights, or random weights to explore different portfolio compositions.

- Return Calculation: KOI includes both capital gains and dividends in return calculations, providing a comprehensive total return measure.

- Annualized Return: Calculates the annualized return based on the date of purchase, offering a standardized performance measure.

- Risk-Adjusted Return: Calculates risk-adjusted returns for your portfolio using the US Treasury yield as the risk-free rate, providing insights into performance relative to risk.

- Sharpe Ratio: Provides the Sharpe Ratio, helping investors assess the risk-adjusted performance of their portfolio.

- Investment Timing with RSI: Calculates the Relative Strength Index (RSI), allowing investors to assess if a stock is overbought or oversold, which can assist in timing investment decisions.

If you are an active investor and a Python lover, my GitHub repository may be of interest to you.

What will change in 2025

After two exceptional years in 2023 and 2024, I approach 2025 with cautious optimism.

Positive Factors Supporting Market Performance:

- Resilient U.S. Economy: Strengthened by a clarified political landscape.

- Capital Inflows: Continued positive momentum into major indexes driven by passive investors.

- Favorable Economic Conditions: Lower inflation and strong labor markets in most regions, though the Chinese labor market remains an outlier.

- Declining Interest Rates: Creating a supportive environment for growth and investment.

- Technological and Environmental Trends: Sustained investment in artificial intelligence and global decarbonization initiatives.

- Shining emerging economies: India and South East Asia are safer bets for sustained growth, Argentina and Brazil offer high potential but carry greater risks, Poland and the Middle East are well-positioned for specific opportunities but are sensitive to geopolitical factors.

Potential Risks and Headwinds:

- Geopolitical Tensions: Persistent conflicts, such as those in Ukraine and the Middle East, continue to pose significant uncertainties.

- U.S. Tariffs: Tariffs could fuel domestic inflation while exerting deflationary pressures in Asia, driving increased currency volatility.

- Government Deficits and Debt: Mounting fiscal imbalances in the U.S. and Europe may strain real economies and delay declines in real interest rates, adversely impacting over-leveraged sectors or businesses (real estate, infrastructure).

- Middle-Class Financial Squeeze: A continued financial strain on the middle class could dampen consumer spending and hinder growth across various sectors.

- Social Tensions: The rapid rewiring of key industries—driven by AI and the energy transition—may lead to swift supply chain restructurings, triggering social unrest and potentially political instability.

However, I remain confident in the fundamentals of the "4Gs portfolio".

My four primary goals for 2025 are to reduce slightly the concentration level of the portfolio, to strategically rebalance the portfolio from Grey to Green investments, to continue enhancing its dividend yield as a defensive measure, and to scout for new small and mid-cap companies to sustain the portfolio's long-term growth potential.

#investmentstrategy #portfoliomanagement #4Gs #climatetech #pythonforinvestors